Second, we also include links to advertisers’ offers in some of our articles these “affiliate links” may generate income for our site when you click on them. This site does not include all companies or products available within the market. The compensation we receive for those placements affects how and where advertisers’ offers appear on the site. First, we provide paid placements to advertisers to present their offers. This compensation comes from two main sources.

TAX EXTENTION FILR FOR FREE

To help support our reporting work, and to continue our ability to provide this content for free to our readers, we receive compensation from the companies that advertise on the Forbes Advisor site. The Forbes Advisor editorial team is independent and objective. This can cause either a delay in processing or it could not be processed at all, which will cause you to have a failure to file penalty (a penalty of 5% per month), so make sure it is mailed to the correct place,” Matthews says. “Sometimes people accidentally send to the wrong place. If you are filing a paper return extension, make sure you mail it to the right address. “People extend for all kinds of reasons and the IRS permits it.” “In my 20 years of working on taxes, I have not seen significant evidence of this,” he says. Read More: Do I Need To File A Tax Return?Īnother major misconception is filing a tax return extension will increase the chance of the return being audited, Matthews says. “It is clearly stated by the IRS on the instructions and their website that an extension of time does not provide an extension for paying the taxes.” “This can be a common mistake people encounter, but the tax filing extension is just that, a filing extension, not a payment extension,” says Daniel Fan, managing director, head of wealth planning at First Foundation Advisors, an Irvine, California-based financial institution. In 2022, most taxpayers must make their tax payment by the original filing deadline of April 18 -even if they file for an extension.

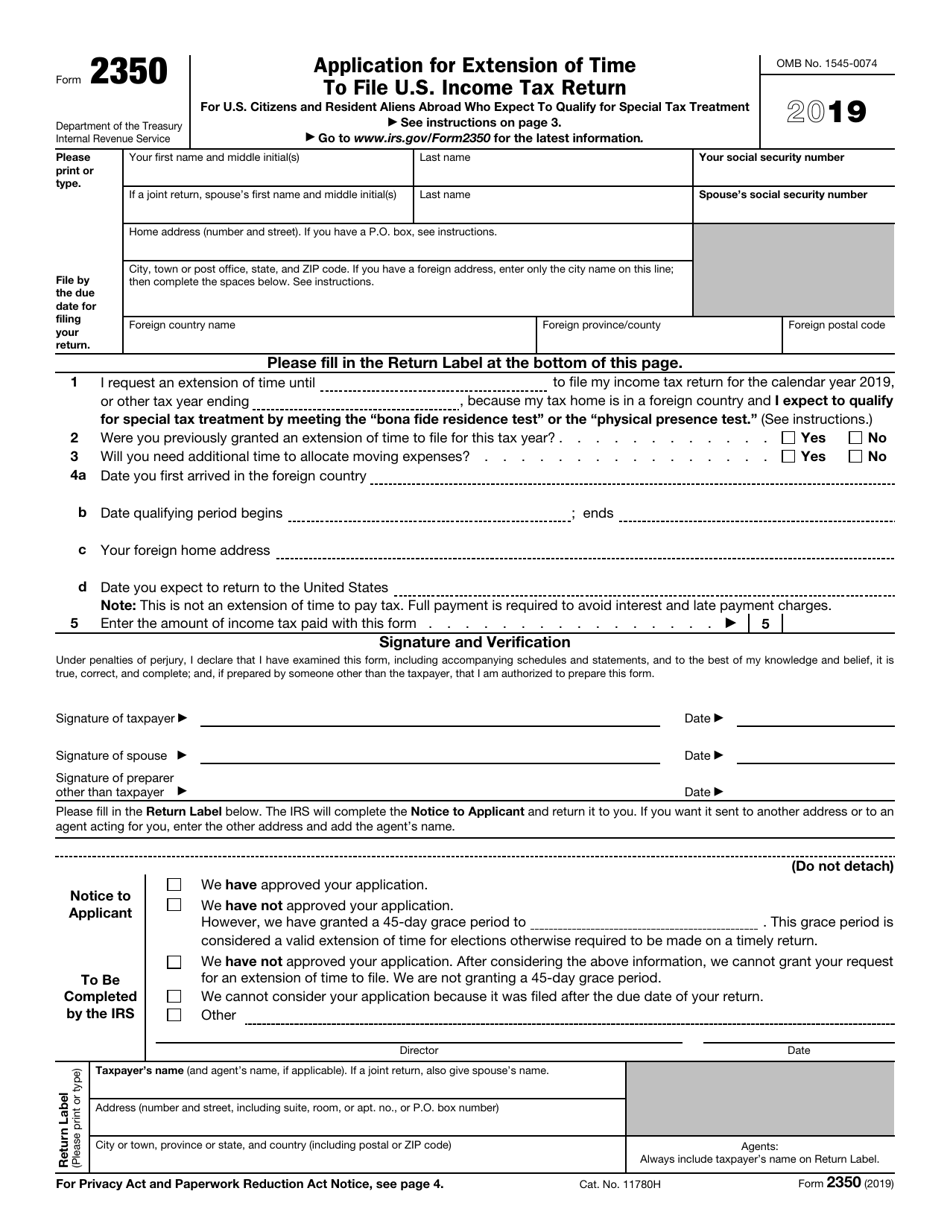

Receiving tax statements late, such as W-2s and 1099s late.However, failing to pay taxes in time can result in penalties and interest charges.”Īccording to Kevin Matthews, an accounting instructor at George Mason University, some common reasons to file an extension include: “This is the biggest mistake that taxpayers make, is thinking that the extension applies to the payment of the tax as well. “Taxpayers need to make tax payments by the original filing deadline based on their best estimate of what the tax will be,” Curtis says. You will still owe any taxes due by your tax filing deadline. Most people who request an extension for filing their tax return have more complicated taxes than, say, Americans who receive a W-2 from their employer and a handful of forms for mortgage interest and student loan interest, so the extended time allows them to gather the necessary information and documentation to file an accurate return.īut importantly, the extension applies to filing the return only, not to the payment of the taxes. “The request form is automatic, so taxpayers do not need to wait for any sort of approval confirmation once the form is submitted,” said Nell Curtis, an accounting instructor at Milwaukee Area Technical College in Wisconsin. The official form to request an extension is Form 4868 and it is less than half a page long-and all extensions will be applied automatically. Taxpayers can complete the extension request form through the IRS Free File website.

TAX EXTENTION FILR SOFTWARE

If you file a tax extension, your deadline for filing is Oct. You may need to file a federal tax return extension for many reasons, including delays in receiving tax statements, living in another country-or you simply need more time getting organized.

0 kommentar(er)

0 kommentar(er)